(Samajweekly) The MPC kept rates and stance unchanged, the latter with the expected dissent from Prof. Varma. While the rate inaction was expected by almost everyone, there was some debate on whether a more qualified stance may now be forthcoming. In the event, the characterisation on stance landed somewhat more hawkish than what may have been expected. We delve into details below.

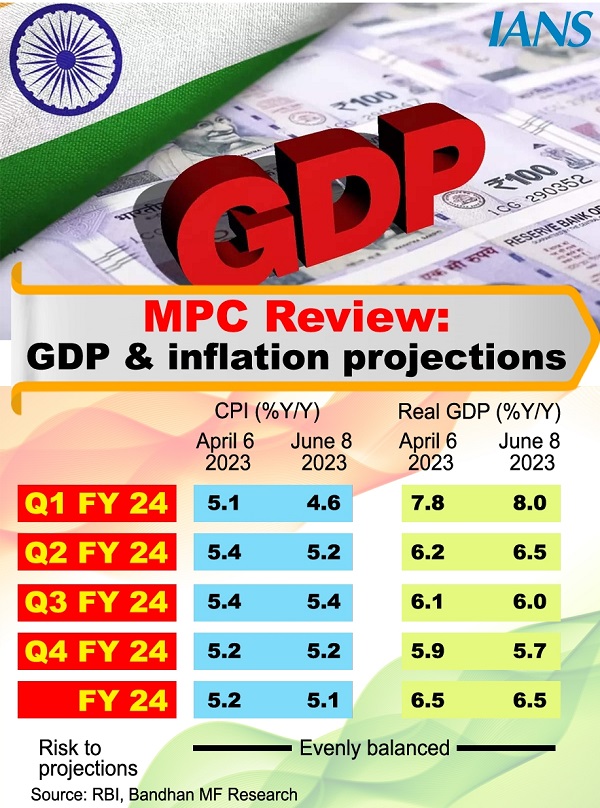

CPI projection has been brought down to reflect the undershoot versus previous expectations for the current quarter. As per our own current forecasts, there is scope for some downside surprise to RBI’s revised CPI forecast for Q2 as well. However, given an evolving monsoon situation, RBI’s conservatism may be understandable here.

The qualitative assessment on inflation sounds optimistic with the Governor noting that the recent easing was across food, fuel, and core categories. Also, with the Rabi harvest remaining largely immune to adverse weather, the near term inflation outlook is deemed to be more favorable than at the time of the April MPC. Also, RBI surveys indicate inflation expectations of households for three months to one year ahead horizon have moderated by 60 – 70 bps since September 2022. At the same time uncertainties are flagged including from the upcoming monsoons. Notably also DG Patra referred to latest MSP hikes contributing 10 – 12 bps to the CPI forecast.

The stance

The crux of the matter today was around the stance and, in particular, the explanation on retaining it at ‘withdrawal of accommodation’. Earlier emphasis here was on both the level of real policy rate as well as liquidity in the system versus a point in time pre-pandemic.

However, in the current review RBI / MPC seems to have de-emphasized real rate with the Governor noting : “With the policy repo rate at 6.50 per cent and full year projected inflation for 2023-24 at just a little above 5 per cent, the real policy rate continues to be positive”.

He goes on: “The average system liquidity, however, is still in surplus mode and could increase as Rs 2,000 banknotes get deposited in the banks” (emphasis ours). Reading together this seems to imply that emphasis on real rates as a barrier for change in stance has waned at current level of repo and forecasted inflation, while liquidity conditions are still relevant. However, and this is where the narrative is somewhat more hawkish than market expectation, there is also still bias to hike further in the statement.

While this is by definition consistent with not moving to neutral (neutral ordinarily implies indifference to which direction the next move may be), it nevertheless will disappoint some of the market expectations around rate cuts starting late this calendar year. Thus the Governor emphasizes CPI still being higher than the target of 4 per cent and the need to persist with getting there, as well as the criticality of a durable disinflation in the core component for a sustained alignment of the headline inflation with the target. �

The Governor also cautions: “Pressure remains during the second half of the year which needs to be watched and addressed at the appropriate time”. Indeed the MPC statement categorically states MPC’s resolve to “take further monetary actions promptly and appropriately as required to keep inflation expectations firmly anchored and to bring down inflation to the target”.

Assessment and takeaways

Given that liquidity conditions are likely to remain healthy over the next few months (FX seems benign and currency in circulation is in reverse, mostly from Rs 2000 denomination notes coming back but also owing to seasonality), inflation will likely be above the 4 per cent target during this period, and risks flagged are for second half of the year, this does suggest that the bar for a stance change is somewhat high for the next policy. And, if that is true then it is hard to expect a rate cut in the very next policy after that. Thus the first ‘window’ for a rate cut now looks to be in December.

However, a common ‘frustration’ with bond markets almost globally has been the resilience of growth from the start of this year. Thus global growth turned out to be much stronger over calendar Q1 than was earlier expected. The same has been seen in India and, as the Governor notes, this seems to be continuing over the current quarter as well.

Absent a significant global deflationary event (Eg: an adverse new financial market development of the order of the earlier US regional bank issue), it is unlikely that growth suddenly faces a ‘road runner’ moment and falls off; especially in an Indian context where there is genuine domestic resilience from improved balance sheets (unlike the West which was fuelled by very large pandemic stimuli). That being the case, RBI / MPC may have the time to be patient before contemplating any modest rate cuts.

However, the above analysis doesn’t mean negative things for the bond market. The fundamental premise for bond investments is to make carry income adjusted for various risks taken (credit, liquidity, and duration).

The biggest challenge to this premise in turn occurs from unmanageable volatility. This was the biggest problem over the past year: volatility was large enough for a long time for risk adjusted carry income not to get realized. However, since then a lot has changed: Most of global rate hikes are behind us, the commodity price shock and supply congestion have largely unwound. Equally importantly, India’s CPI and current account dynamics have improved substantially.

In our view, this is largely because as external shocks have passed inflation dynamics are now being driven in individual countries by their respective policy responses in the period post the pandemic striking. As an example, the US had an aggressive fiscal response which is still driving its local inflation dynamics. India’s response was much more measured and hence this factor isn’t in play here. Accordingly, inflation is largely responding to the passing of the global shock.

All of this means that Indian bond market volatility is now likely to be very much in a manageable zone. This has already been in play for the past few months when significant movements in US treasury yields are no longer influencing Indian yields to the extent they used to last year. Thus it is likely that the probability of earning carry from bonds is now much stronger than what was the case last year. But this is not enough.

We need to answer allied questions as well: If carry is the game then isn’t credit the name? Not necessarily. Apart from fundamental reasons to always have a quality book in fixed income (even if one is doing credit on the margin through satellite funds) there are very strong cyclical reasons to take into account. While concurrently the world is doing well, this is still in context of unacceptably high developed market (DM) inflation. Thus we aren’t anywhere close to an equilibrium or resolution. Further the lagged impact of this aggressive DM hiking cycle is yet to play out fully. Not just that, the ability of DM central banks to respond to future crises (the famed Fed ‘put’) is now considerably weaker given the inflation episode that they are being subjected to now. Finally, the starting point today is for most credit market pricing to be quite benign given that the underlying narrative itself currently is quite benign.

In summary adding procyclical risk makes the most sense when the timing is towards the end of a ‘bust’ cycle or if the pricing has cushion to accommodate that scenario or if you are reasonably sure that you are so far away from the scenario that it doesn’t realistically matter.

Market pricing on credit risk seems to reflect the third of these today and so far this view has been right, given that growth has held up better than what was generally feared (hoped for?). This is unlikely to be the case, however, given the disequilibrium referred to above. While there is one probabilistic scenario where there is orderly disinflation in the West which then leads to a loosening of financial conditions in a methodical manner, there are other scenarios where this cycle resolves in a much less benign fashion. Asset allocations cannot be built on one probable scenario only while ignoring others especially when pricing for risk isn’t particularly attractive as well. As spreads widen over the course of the next few quarters and / or the narrative clarifies itself, credit can then be selectively added in satellite allocations.

One last area to address: if risk adjusted carry is the game, then why not focus on the very front end alone? We still prefer medium duration (3 – 6 year maturities) because reinvestment risk will likely need addressing sometime down the line. In our view, and for reasons mentioned above, we are at a ‘mature’ part of the global cycle and this is likely to be followed by some monetary easing next year. Medium duration bonds allow for plugging likely reinvestment risks without inviting excessive volatility on account of duration risk. This view can be revisited or reaffirmed at some point in the future when the path is clearer.