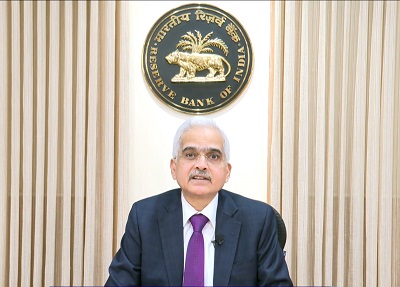

Mumbai, (Samajweekly) RBI Governor Shaktikanta Das said on Friday that the latest data as at end-December 2023 shows that the key indicators of capital and asset quality of scheduled commercial banks continued to be healthy, and financial indicators of non-banking financial companies (NBFCs) are also in line with that of the banking system.

“Let me emphasise here that banks, NBFCs and other financial entities must continue to give the highest priority to quality of governance and adherence to regulatory guidelines. Financial sector players, by and large, operate with public money – be it of the depositors in banks and select NBFCs or investors in bonds and other financial instruments. They should always be mindful of this,” Das pointed out.

He said that the Reserve Bank will continue to constructively engage with financial entities in this regard and it needs to be recognised that financial stability is a joint responsibility of all stakeholders.

Das said that the RBI has also been engaging with regulated entities and various stakeholders to simplify its regulations and reduce the compliance burden.

As part of this endeavour, the recommendations of the Regulations Review Authority (RRA 2.0) constituted by the Reserve Bank have been largely implemented. Moving further in the same direction, Internal Review Groups were formed in 2023 to rationalise, simplify and remove obsolete regulations and streamline reporting mechanisms, he added.

Das said that in pursuance of recommendations of RRA 2.0 and the Internal Review Groups, more than 1000 circulars have been withdrawn. A Master Direction for rationalising and harmonising supervisory returns has also been issued.

The Reserve Bank will continue to follow a consultative approach and undertake a review of regulations in line with the evolving financial landscape, he added.