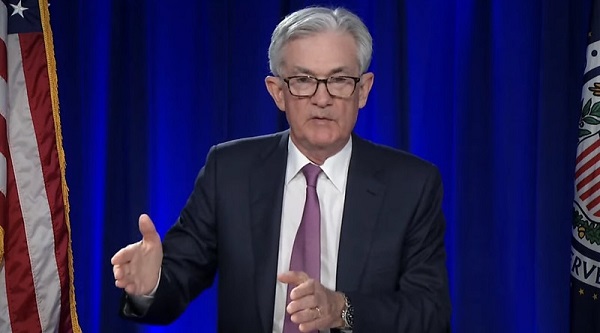

Washington, (Samajweekly) US Federal Reserve Chairman Jerome Powell stressed on Tuesday that central bank policymakers are prepared to raise interest rates higher than previously expected and pick up the pace of increases in the face of hotter-than-expected economic data, according to a media report.

“The latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated,” Powell said in remarks prepared for delivery before the Senate Banking Committee, Fox Business reported.

“If the totality of the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes,” he said.

Central bankers are in the midst of the most aggressive campaign since the 1980s to crush persistently high inflation. Although the consumer price index has slowly fallen from a high of 9.1 per cent notched in June, it remains three times higher than the pre-pandemic average, Fox Business reported.

The Fed’s rate-setting committee meets later this month.

Markets widely expect the Fed to continue raising rates at a quarter-point pace, but a slew of hotter-than-expected economic data reports in recent weeks � including the blowout January jobs report and disappointing inflation data that pointed to the pervasiveness of high consumer prices � has raised the specter of a higher peak rate or steeper increases, Fox Business reported.

The Labour Department reported in February that the consumer price index rose 0.5 per cent in January, the most in three months. The annual inflation rate also surprised to the upside at 6.4 per cent.

“We will continue to make our decisions meeting by meeting,” Powell said, adding, “Although inflation has been moderating in recent months, the process of getting inflation back down to 2 per cent has a long way to go and is likely to be bumpy.”